-

2018 end of year ECommerce review

16 Jan 2019 Dominic Comments Off on 2018 end of year ECommerce review

End of year reviews are essential in any business and moreso when working in what I like to call “brand recovery” environments i.e. where the focus of the year’s trading is to overhaul and reverse a decline in performance. A recent client of mine was in just such a position – with YOY decline due to a number of factors:

- Lack of investment

- Lack of innovation

- Poor stock control

- Inadequate systems

- No KPI measurement

I have documented in some other blog posts my role in addressing these issues and providing a growth roadmap for the business – ie halting the decline in sales, traffic, customers etc. Towards the end of week 1 in January, I took some time out to review the 2 main areas:

2018 – Ecommerce KPIs

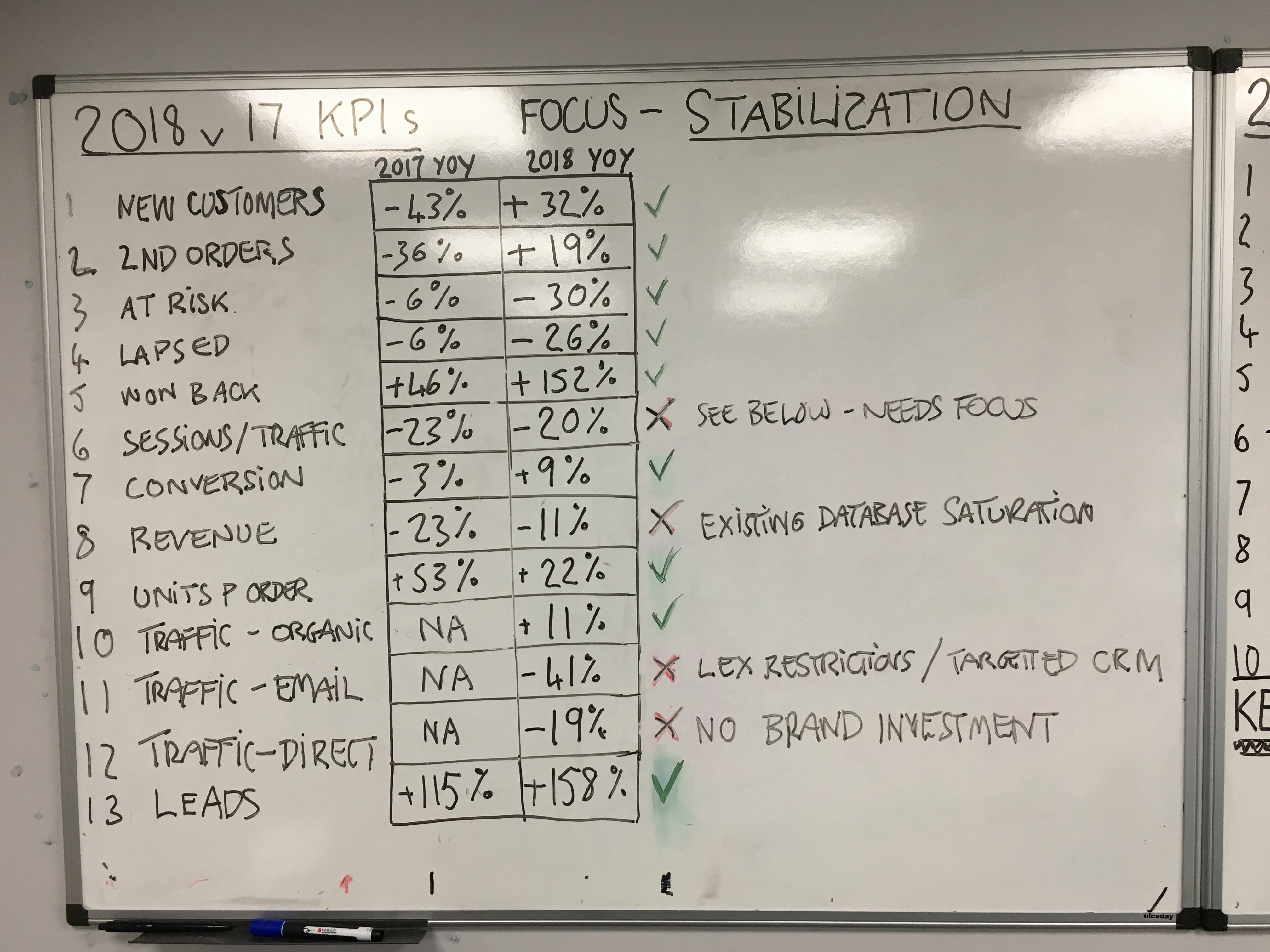

00It is essential to define and track the KPIs which you are focused on to deliver. For this business, these KPIs were:

New customers – a huge jump from -43% to +32% YOY primarily down to increased focus on SEO and improved rankings of non brand terms.

2nd Orders – again another huge jump YOY by +19% from -36% as we focused on defining customer segments for entry level products and adjusting 2nd order marketing to suit those first product purchases.

At risk – the number of customers at risk dropped from -6% to -30% as we ensured we provided more relevant offers before customers got to “at risk” status.

Lapsed – lapsed customers also declined from -6% to -26% for the same reasons as above – greater relevance.

Won back – an increase from +46% to 152% was achieved again as we improved relevance of offers and promotions to different customer types.

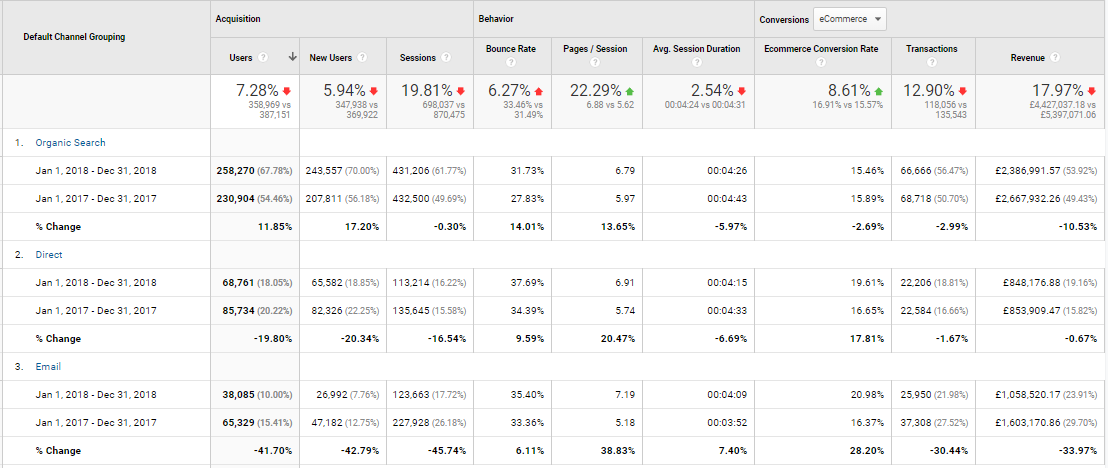

Sessions / Traffic – traffic had been in decline for 4 years and 2018 also saw a drop in traffic but not as much as year before. Another issue affecting traffic was stricter regulatory control over promotions.

Conversion – an increase of +9% was attributable to improved stock levels and more relevant traffic – the more relevant, the higher the likelihood of conversion.

Revenue – YOY decline in revenue was not halted but was less than previous year as the business focused more on offering relevant offers (3 for 2s etc) rather than blanket discounting (eg 20% off everything).

Units per order – one of the big promotions in this sector which we were not doing for a number of reasons was the 3 for 2s. We introduced this promotion and this contributed to a 22% increase.

Leads – a jump from +115% to +158% as we reviewed and improved both the prominence of overlays and discount on first orders.

Traffic (organic) – an increase in +11% YOY was down to investment in SEO which drove increased traffic plus increased new customer numbers significantly from 50% to 65% of all new customers derived from organic traffic.

Traffic (direct) – this channel saw a decline of -19% – as mentioned above, the brand had been in decline for some years and this was impacting Direct and Brand traffic to the site (investment required to drive).

Traffic (email) – regulatory changes impacted the email volumes as emails could not be “promotional” for 5 months of the year – only informative emails could be pushed during this period.

002018 – Issues to address

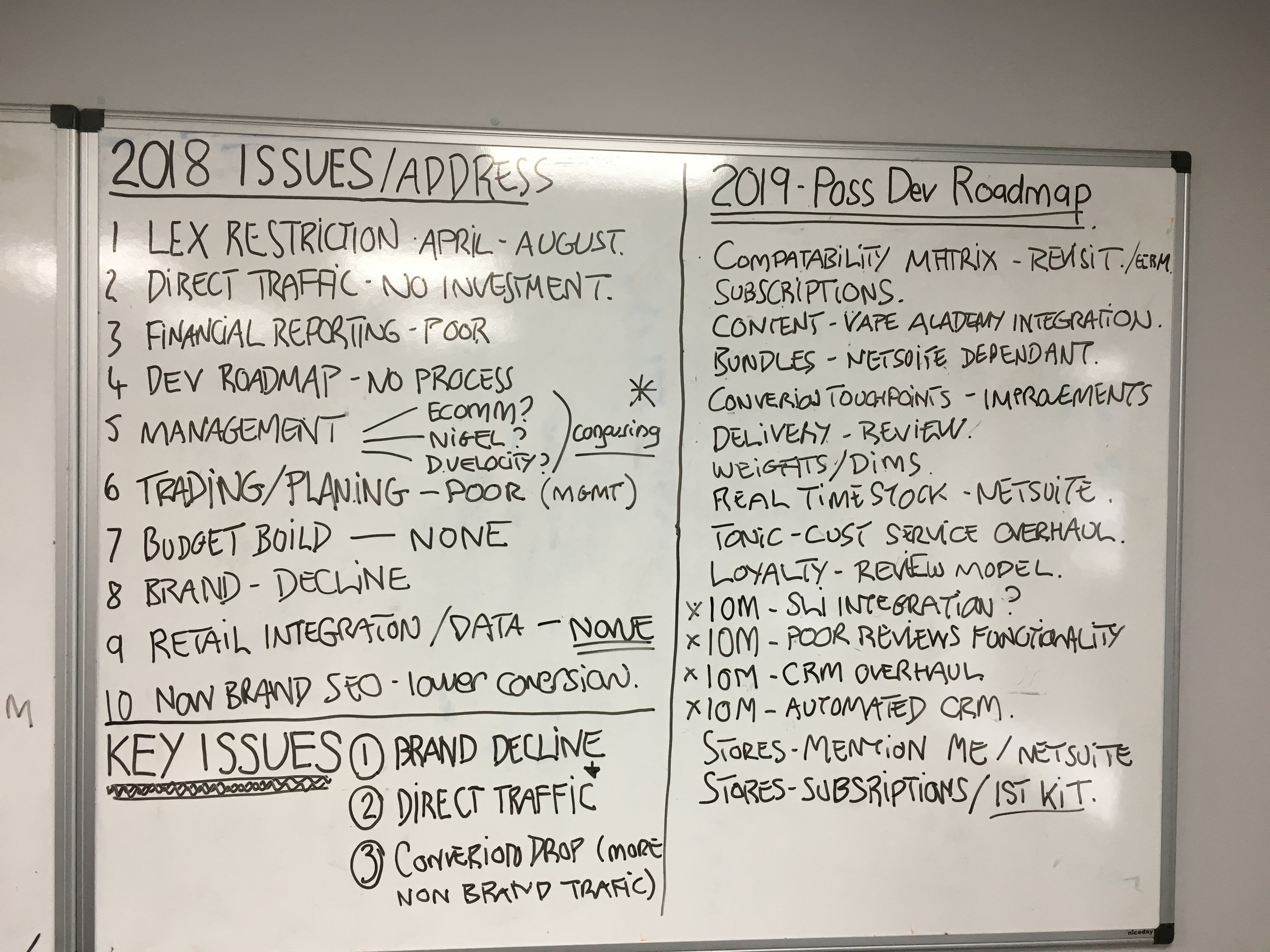

It is essential to sit down every January and honestly review the year previously – identifying what you feel are the main issues to resolve which will improve on the following year’s performance. Every company has challenges – be they in reporting, people, budgets etc – to drive the key business objectives, any obstacles to delivering these objectives need to be addressed. These are the main issues I identified with this current client:

00Legal restrictions – this client operates in a quite restrictive market in terms of what it can and cannot say online. Some of these restrictions are quite subjective and, to budget for growth, a promotional startegy needs to be agreed.

Direct traffic – as mentioned above, the brand has been in decline for some time and the direct impact of this is less direct and brand traffic to the website YOY. The brand needs investment and campaigns / strategies agreed to drive website traffic and re-invigorate the brand online.

Financial reporting – Every company needs adequate financial reporting and agreement on the KPIs being tracked. This business has struggled to deliver accurate financial reporting agreed by all parties and as such, sales performance on a weekly and ad hoc basis has been difficult to agree on.

Development Roadmap – Ecommerce is continually changing and to continue driving sales, I firmly believe in agreeing an outline development roadmap in agreement before trading year begins. This needs to be budgeted and impact mapped out across websites.

Management – Ownership of sales and revenue KPIs needs to be agreed – who is actaully driving revenue? In this business, management has been an issue with ecomm team / head of department and ecomm agency all getting involved in driving development. This can be confusing – agree upfront who manages and then let them manage the channel.

Trading / Planning – Retail Ecomm planning in my experience is typically planned in Sept / Oct each year – review performance, good, bad, channels ect and from that get an idea of next year plans with dev work included to drive increased sales, AOVs etc.

Budget build – Tied in with trading and planning is working this up into a budget build – what extra revenue will each new channel or activity bring in on top of organic or planned growth. Modelling these out should then provide an outline budget for the following year to track KPIs.

Brand decline – mentioned above numerous times but one again – when a brand has been in decline for some years, it needs more than simply new products to re-ignite it with prospective customers. Investing in brand re-ignition will take significant budget along with clear focus on KPIs required to improve direct / brand traffic.

Retail integration – For this company, retail integration has been the single biggest opportunity to implement but, with systems needing overhauled and implemented, integration of ECommerce with Stores is still not happeing. My experience of retail integration is that the multichannel customer AOV will be highest of the channels in the business so needs to be a focus in 2019.

Non brand SEO – Finally non brand SEO has been one of ths successes of the year and has driven significant traffic HOWEVER as this traffic is non brand (ie they are looking for a Vaping Kit as opposed to just the company selling it), they do not know about the company – they are harder to sell to therefore conversion rate is lower – there is a finite amount of traffic this channel can send.

Categories: All Posts, Planning, Small Business Blog, Strategy, Why me?

Tags: Digital Marketing, planning

Email Database increase by 40% in 6 months! Email automation driving incremental sales of 20%

Categories

- Acquisition (4)

- AI (2)

- All Posts (41)

- Data Science (1)

- Amazon (1)

- Analytics (6)

- Brand (9)

- Conversion (12)

- Customer Surveys (2)

- DXP (1)

- Email (4)

- Google (6)

- Mobile (2)

- Paid search (5)

- Planning (9)

- Platform (4)

- Presentations (2)

- Promotions (3)

- RAF (1)

- Retention (7)

- SEO (6)

- Site Search (1)

- Small Business Blog (3)

- Social Media (4)

- Strategy (9)

- Trading Tips (18)

- Traffic (5)

- Uncategorized (8)

- Why me? (6)

Comments are currently closed.